Annotated: Sam Bankman-Fried's "FTX Pre-Mortem Overview"

Sam Bankman-Fried has apparently decided to fill his time spent confined to his parents' Palo Alto home with blogging, perhaps in the hopes that he can just blog his way out of the massive criminal and civil penalties he's facing.

Although many of his statements here repeat things he's said elsewhere, I think it is useful to be able to analyze some of the story he's trying to spin all in one place, rather than cobbling his narrative together from multiple sources.

It's remarkable the extent to which SBF outright lies, or at the very least twists his version of events to distort reality in his favor. I don't intend to annotate further posts from him—which I suspect will be many—but instead hope that this will be sufficient to give some idea of just how thoroughly misleading his statements are.

It's probably a bad sign that SBF is starting right out the gate with a blatant lie. He is—once again—claiming that everything at FTX was just fine until disaster struck in November. In reality, November was when the general public learned that FTX had been insolvent for a while, 1 2 propping up its balance sheet with illiquid tokens they themselves had created and extending loans of billions of dollars of customer assets to Alameda Research. Those loans, which were made possible through a backdoor in FTX's software that was added at SBF's instruction, 3 and which effectively extended Alameda a line of credit capped at $65 billion, 3 are never addressed in this blog post by SBF.

As alleged in a complaint by the CFTC, "In approximately May and/or June 2022, Alameda was subject to a large number of such margin calls and loan recalls. It did not have sufficient liquid assets to service its loans. Instead, at the direction of Bankman-Fried, Alameda greatly increased its usage of FTX customer funds to meet its external debt obligations." 1 No one in their right mind would use the word "solvency" to describe this.

The only way that the FTX bankruptcy falls between Celsius and Voyager is if you are sorting them alphabetically.

Celsius disclosed a $1.2 billion hole in its balance sheet in bankruptcy filings. 4 The Voyager shortfall is less clear—their original bankruptcy filing estimated it at around $187 million, 5 but because of their exposure to FTX it's likely that their assets declined substantially after the FTX collapse. Regardless, their total liabilities are estimated at $4.9 billion, giving a rough upper bound. 5

FTX's shortfall was last explicitly estimated to be around $8 billion, which puts FTX squarely outside of the Voyager/Celsius range. To be a little charitable, it's possible that SBF is subtracting the $5 billion of found assets (announced by FTX legal counsel in a hearing on January 11, 2023) from his total estimated shortfall in November, 6 and is also assuming that Voyager has very few assets compared to their total liabilities. However, the current FTX legal team has not provided more up-to-date estimates of the shortfall, and it's likely to differ substantially from SBF's napkin math. In the same January 11 court hearing where they announced the asset recovery, they explicitly stated that the total shortfall remained unclear.

Three things combined together to cause the implosion:

- Over the course of 2021, Alameda's balance sheet grew to roughly $100b of Net Asset Value, $8b of net borrowing (leverage), and $7b of liquidity on hand.

- Alameda failed to sufficiently hedge its market exposure. Over the course of 2022, a series of large broad market crashes came–in stocks and in crypto–leading to a ~80% decrease in the market value of its assets.

- In November 2022, an extreme, quick, targeted crash precipitated by the CEO of Binance made Alameda insolvent.

This simply doesn't jibe with the fact that, per their own reporting in 2021 tax returns, FTX and Alameda appear to have been wildly unprofitable enterprises, 7 even during periods of crypto mania when it seemed nearly impossible to lose money.

Later on in the blog post, SBF reveals that he's still incorporating completely illiquid tokens when estimating Alameda's net assets.

It's certainly accurate that this

FTX/Alameda contagion has spread far and wide, but SBF is again claiming that everything was fine and dandy at FTX

up until the November Alameda explosion, as if FTX hadn't been lending

billions in customer funds—amounts exeeding FTX's total lifetime

revenue—to Alameda in exchange for a pile of magic beans $FTT

tokens.

8

9

SBF also notably fails to mention that this same contagion impacted FTX and Alameda. Even though they may have escaped direct exposure to Three Arrows Capital, the fallout from this collapse resulted in lenders recalling billions of dollars in loans from Alameda. The SEC identifies this as one event that caused SBF to direct FTX to "divert billions more in customer assets to Alameda". 2

This links to a tweet about a press release by the Securities Commission of the Bahamas, where they claimed to have seized FTX crypto assets "valued at more than US$3.5 billion". 10

The US legal team overseeing the FTX bankruptcy described this estimation as "reckless in the extreme", saying that if the seized assets are what they believe them to be, the Bahamian authorities are talking about illiquid assets (primarily $FTT) likely sellable at $167 million at the very most. 11

That's his story, and he's sticking to it.

Meanwhile, FTX's new CEO overseeing the bankruptcy, John J. Ray III, has testified in front of Congress that there is "clearly not" evidence backing SBF's various statements that FTX US is completely solvent. 12

The CFTC complaint says that FTX executives were not able to establish that FTX was solvent on November 7, shortly before the collapse. "Bankman-Fried quickly indicated that he would fill the hole at FTX US from liquidation of Alameda assets," says the complaint 13 —holes being things that only tend to exist at insolvent companies.

How selfless. Except that on January 5, he filed an objection to the FTX debtors' motion to retain control over ~$450 million in Robinhood shares, arguing instead that the shares belonged to him personally (not the bankruptcy estate, which would eventually disburse them to creditors) and should be available for his legal defense. 14 Nevermind that the shares were acquired thanks to $546 million in personal loans from Alameda Research, 15 who themselves were improperly borrowing customer funds from FTX.

The argument here is, I guess, is "give me the shares and then I will give the money I don't use on my legal defense to customers, I promise".

SBF has also previously claimed that he only had $100,000, that he didn't know how he was going to pay for his legal representation, and that "basically everything I had was just tied up in the company", so something's not adding up here. 16

Notes

This post is about FTX International's (in)solvency.

It's not about FTX US, because FTX US is fully solvent and always has been

When I passed FTX US off to Mr. Ray and the Chapter 11 team, it had around +$350m net cash on hand beyond customer balances. Its funds and customers were segregated from FTX International.

It's ridiculous that FTX US users haven't been made whole and gotten their funds back yet.

Here is my record of FTX US's balance sheet as of when I handed it off:

This is another one of those fun things that SBF likes to refer to as a "balance sheet" that is actually nothing like a balance sheet.

Dear @SBF_FTX. This is not a balance sheet. A balance sheet doesn't record "balances", it records assets on one side of the sheet and liabilities plus equity on the other. The "balance" is whether the totals on the two sides agree. #basicaccounting pic.twitter.com/WqabBjmLli

— Frances 'Cassandra' Coppola (@Frances_Coppola) January 20, 2023

SBF seeks to show that FTX US was solvent when he resigned as CEO, but doesn't address whether more than $185 million in assets were madly shuffled (at his direction) into FTX several days prior to fill a shortfall, as alleged by the CFTC. 19

This, along with the repeated claims of FTX US's solvency, seems to me to be the primary thrust of SBF's argument here. "Sure, maybe things went pear-shaped at FTX International [as a result of massive fraud], but FTX US was fine, I'll give the money back, and then you won't have jurisdiction to prosecute me".

Even if we suspend disbelief for a moment and take SBF at his word that FTX US is solvent and could repay customers at any moment, I still don't think this holds water. US prosecutors seem to be pretty good at finding jurisdiction if they wish, and this high-profile case where a substantial number of Americans are clamoring for the justice department to do something, dammit seems like a case where they would. John J. Ray III has also already confirmed that there were some US citizens using FTX International, 20 so that would likely help with jurisdiction issues.

(In fact, it was primarily headquartered, run from, and incorporated in The Bahamas, as FTX Digital Markets LTD.)

This is the same argument that Bahamian liquidators were using to try to argue that the bankruptcy should be primarily handled there. 21 SBF wants that too.

The US legal team has gone so far as to accuse the Bahamian government and liquidation team as being in cahoots with SBF: "the Debtors continue to uncover information indicating that the [joint provisional liquidators] and the Bahamian government colluded to deplete the Debtors' estate assets." 22

They've objected to the idea that FTX Digital Markets was the primary nexus of FTX, referring to it as "a virtual nullity within the FTX group": "It was nothing more than a short-lived provider of limited 'match-making' services for customer-to-customer transactions, on the cryptocurrency exchange built, owned, and operated by Debtor FTX Trading, its immediate corporate parent. FTX DM operated for just under six months, from May 13, 2022 to November 10, 2022. Over 90% of customers who used the FTX.com exchange were customers before FTX DM even became operational. Once operational, FTX DM never earned a dollar of third-party revenue." 21

US customers were onboarded to the (still solvent) FTX US exchange.

Senators have raised concerns about a potential conflict of interest from Sullivan & Crowell (S&C). Contrary to S&C's statement that they "had a limited and largely transactional relationship with FTX", S&C was one of FTX International's two primary law firms prior to bankruptcy, and were FTX US's primary law firm. FTX US' GC came from S&C, they worked with FTX US in its most important regulatory application, they worked with FTX International on some of its most important regulatory concerns, and they worked with FTX US on its most important transaction. When I would visit NYC, I would sometimes work out of S&C's office.

There are certainly reasonable concerns about Sullivan & Cromwell's involvement with the FTX bankruptcy given their past work with FTX (where they presumably should have spotted some of the massive fraud happening, or at least the lack of controls to ensure it didn't). On January 20 (subsequent to the publication of this blog post by SBF), Judge Dorsey ultimately overruled objections to their retention by two individual FTX creditors. 23

The GC (general counsel) that SBF is avoiding naming here is Ryne Miller.

SBF has claimed several times—including in his planned Congressional testimony—that he was forced to declare bankruptcy by Sullivan & Cromwell. 24 In the draft, he says he believes this is due to the fees that S&C could earn from a bankruptcy, citing $700 million in legal fees that went to law firms including S&C in the Enron bankruptcy. 25

However, the idea that everything would be just fine if he'd never resigned and brought in the bankruptcy team is ludicrous. It's wild for him to argue that the issue is the bankruptcy, not all the fraud.

This presumably includes FTT and various other tokens, which were not just "illiquid", but whose price was intentionally and fraudulently manipulated by Caroline Ellison at SBF's direction (as alleged by the SEC). 26

Any claim by SBF where he describes his former companies' assets denominated in USD should be treated with extreme skepticism, given his past willingness to claim that FTX at one time had $FTT worth $5.9 billion real US dollars, despite the token having nowhere near the kind of liquidity that could support that. 27

"I believe that if FTX International were to reboot, there would be a real possibility of customers being made substantially whole."

Couch that a little more, won't you? The money's gone.

This sentence was added to the post sometime between 5:02am January 15 and 11:53pm January 16 (Pacific Time), three to four days after SBF originally published it.

SBF himself has admitted that assets of customers who were solely spot trading were not segregated from assets of those trading with leverage (as they were supposed to be), 18 so this statement appears purely based on the belief that the debtors could scrape together enough assets from somewhere to prioritize making the spot traders whole first.

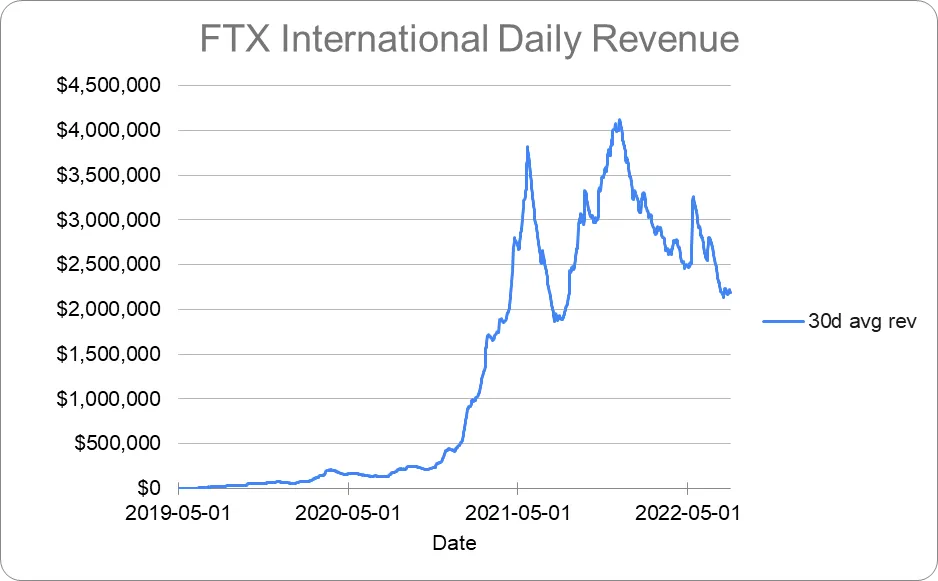

A revenue chart is not terribly useful without information on expenses, or their outstanding liabilities.

Furthermore, this chart shows FTX bringing in between $2 and $4 million per day in the past year or so. If we look at the $8 billion hole estimated to exist in the FTX balance sheet, even if FTX was consistently making $4M a day, it would take them more than five years to plug a hole of that size.

In an Antiguan court filing, SBF attests that he and Gary Wang borrowed $546 million from Alameda in order to buy shares in Robinhood. 16 In a filing in the US bankruptcy case, SBF argues the shares belong to him, and that he should be allowed to dip into them to pay for his criminal defense. 14

If SBF is not outright lying (and he almost certainly is), then he is engaging in some Olympic-level mental gymnastics along the lines of "the investments of a shell company I created, for which I own 90% of the shares, and into whose assets I can dip to pay my own personal expenses, are not technically 'my investments'".

FTX reportedly spent around $256 million on real estate in The Bahamas. 31 If SBF thought that's 10% of what Coinbase pays its employees, then he estimated Coinbase spends $2.56 billion on its employees per year.

Except SBF did a tweet thread last summer about Coinbase's most recent (Q2 2022) earnings report, where he estimated Coinbase spends $4.4 billion annually on employees. 32 So is he saying that FTX actually spent $440 million on real estate? Or has he revised his Coinbase estimate (which was quite high—he was estimating an average of around $884,000 per year in compensation for all employees)? The other possibility is that he was saying Coinbase spends $2.56 billion a year specifically on real estate for employees, but that seems like an outlandish claim even by SBF's standards.

Setting aside that the numbers don't add up, it's weird to try to justify spending by comparing your company's expenses on real estate for employees to total employee expenses for a company that also has 10 times as many employees (which was more like 17 times as many earlier this year, before Coinbase performed two rounds of layoffs). 33

Voyager was "impacted" by 3AC's collapse because 3AC defaulted on a massive loan. FTX was "impacted" by Alameda's decline because they had fraudulently loaned billions of dollars of customer assets to Alameda in exchange for magic beans.

But yeah, for sure!

SBF seems to still be hoping that he can pin all of this on Caroline Ellison, Alameda's CEO. Unfortunately for SBF, both she and Gary Wang (FTX co-CEO) are cooperating with authorities, and have testified that SBF was deeply involved in Alameda operations even after he claims he had stepped away.

The CFTC claimed in its complaint that SBF "maintained direct decision-making authority over all of Alameda's major trading, investment, and financial decisions" and had "regular, often daily participation in various in-person and mobile chat communications with senior personnel at Alameda". 36 The SEC made similar allegations, claiming that SBF "remained the ultimate decision-maker" after stepping down as CEO, and that he "directed investment and operational decisions, frequently communicated with Alameda employees, and had full access to Alameda's records and databases." 37

So much of this is pieced together post-hoc, coming from models and approximations, generally based on data that I had prior to resigning as CEO and modeling and estimations based on that data.

Overview of what happened

2021

Over the course of 2021, Alameda's Net Asset Value skyrocketed, to roughly $100b marked to market by the end of the year by my model. Even if you ignore assets like SRM that had much larger fully diluted than circulating supplies, I think it was still roughly $50b.

And over the course of 2021, Alameda's positions grew, too.

In particular, I think it had about $8b of net borrowing, which I believe was spent on:

- ~$1b interest payments to lenders

- ~$3b buying out Binance from FTX's cap table

- ~$4b venture investments

(By 'net borrowing', I mean, basically, borrowing minus liquid assets on hand that could be used to return the loans. This net borrowing in 2021 came primarily from third party borrow-lending desks–Genesis, Celsius, Voyager, etc., rather than from margin trading on FTX.)

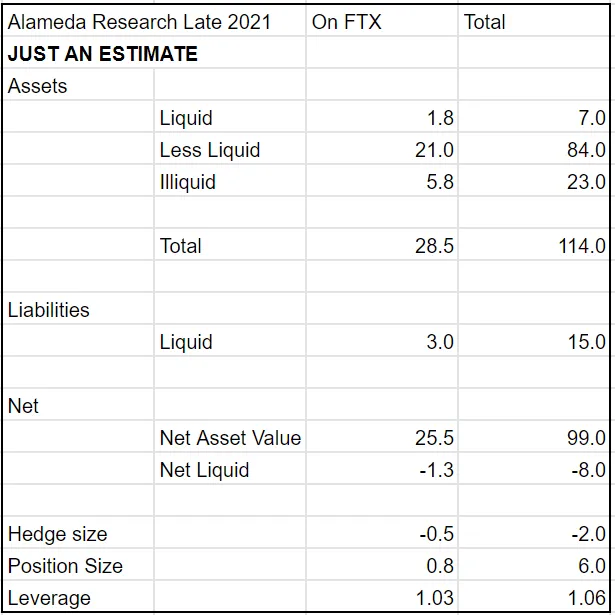

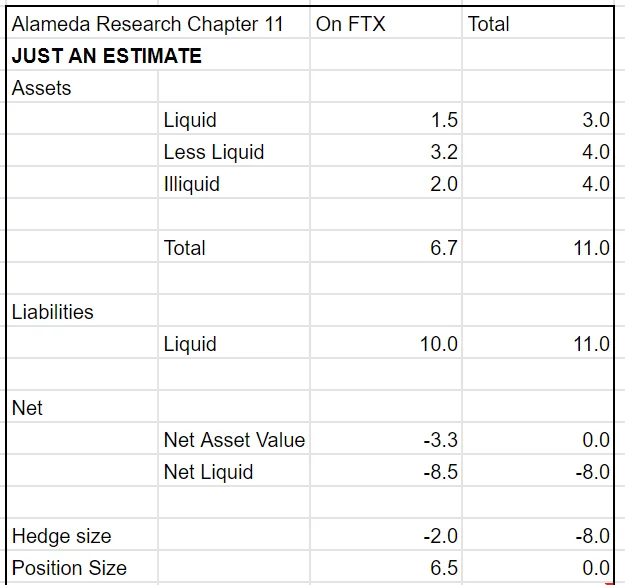

So by the start of 2022, I believe that Alameda's balance sheet looked roughly like the following:

We know from the leaked balance sheet published by the Financial Times in November that SBF's definition of "less liquid" is... very generous. 27 Among the assets he listed there as "less liquid" was FTT, an extremely illiquid token that was created by FTX, and whose price was actively manipulated by Alameda Research at SBF's direction (as alleged by the SEC). 26

Other tokens SBF listed as "less liquid" were SRM, OXY, MAPS, and FIDA, which are all referred to as "Samcoins" because they were so tightly linked to SBF and his companies. Alameda held far more of those tokens than were in circulation, making it impossible for Alameda to liquidate substantial amounts of those tokens for anywhere near market price. 38

We can see from this estimation that the significant majority of Alameda's assets were "less liquid" or "illiquid" tokens, many of which were closely tied to, if not actively manipulated, by Alameda—hardly the solid financial footing SBF is trying to portray.

All of his math, and his statements about how reasonable Alameda's positions were, are predicated on the idea that these magic beans cooked up by FTX itself were worth billions of dollars.

- ~$100b NAV

- ~$12b liquidity from 3rd party desks (Genesis, etc.)

- ~$10b more liquidity it likely could have gotten from them

- ~1.06x leverage

In that context, the ~$8b illiquid position (with tens of billions of dollars of available credit/margin from third party lenders) seemed reasonable and not very risky.

I think that Alameda's SOL alone was enough to cover the net borrowing. And it was coming from third party borrow-lending desks, who were all–I was told–sent accurate balance sheets from Alameda.

Once again attempting to distance himself from Alameda with "I was told".

It's clear that SBF's definition of "accurate" differs from most people's. SBF seems to think that if you tell someone that you have $1,000, and then later you say "...in monopoly money", it was still an accurate and defensible statement.

It's not yet clear to what extent counterparties to FTX and Alameda understood that those businesses were propped up on illiquid tokens that they themselves had created, but there may be some blame to be laid with the counterparties as well. The SEC is already investigating whether FTX investors performed proper due diligence; 39 it would not be unreasonable to expect similar questions to be posed to their lending partners. Genesis, Voyager, and Celsius are all undergoing bankruptcy proceedings at the moment, and I am sure their many creditors will be interested to know those firms properly evaluated lending risk when extending loans that ultimately resulted in bankruptcy. Indeed, Celsius CEO Alex Mashinsky described the company's lending strategy to customers as low-risk, and those are among the statements over which he is now facing criminal fraud charges. Those criminal charges specifically call out Mashinsky's decision to lend a total of around $1 billion to Alameda, the fact that much of Alameda's assets were held in FTT, and his decision to accept FTT as collateral for the loans. 40

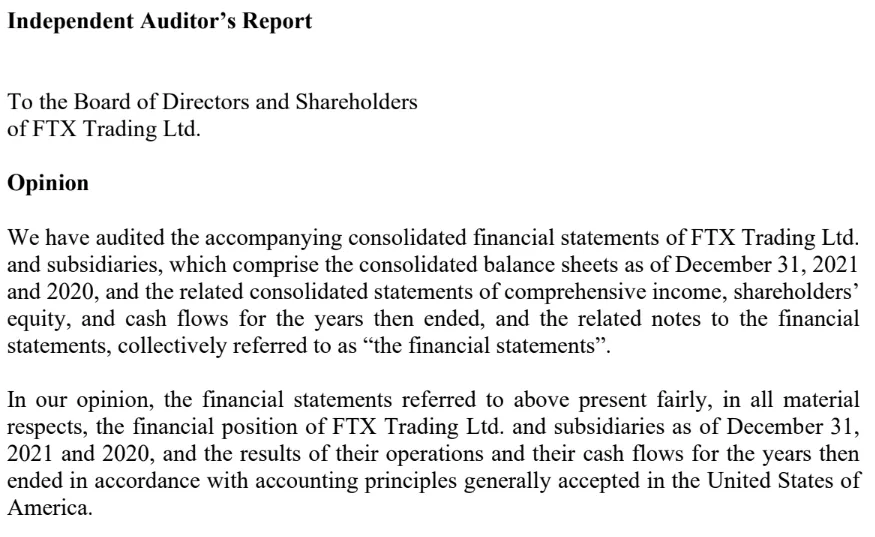

GAAP refers to "generally accepted accounting principles". FTX US was audited by Armanino, and the offshore FTX groups were audited by Prager Metis. It's not clear why two different firms would perform the audits. "With the benefit of hindsight, we can see it perhaps suggested that Bankman-Fried didn't want any firm to see the whole picture," says Francine McKenna, an investigative journalist, professor, and accounting expert. Neither Armanino nor Prager Metis is a "Big Four" accounting firm, and McKenna describes them as "two small outfits, not even on the next tier to the Big Four". 42 Armanino has since announced they will no longer audit crypto clients. 43

McKenna detailed a list of red flags that probably ought to have been noticed by the auditors, including including hiring two separate auditing firms, lack of scrutiny into FTX's internal accounting and reporting controls, lack of federal income taxes paid despite reported profits, and the "number of complex, roundtrip and utterly confounding related-party transactions documented in just these two years". 42

As of the end of 2021, then, it would have taken a ~94% market crash to drag Alameda underwater! And not just in SRM and assets like it–Alameda was still massively overcollateralized if you ignore those. I think that its SOL position alone was larger than its leverage.

Or massive fraud. Fraud probably would've worked then too.

SBF likes to talk about all the things Alameda did or didn't do, because it's a useful way to distract from the fact that Alameda had free reign to wreak havoc on FTX thanks to the effectively unlimited line of credit that he extended to the company. Alameda should never have had access to FTX customer funds, nor the ability to bring the whole company down with its bad trades (which should have been getting liquidated like anyone else)—that's the important part.

SBF did shady stuff in the hopes that nothing bad would happen at Alameda, and no one would notice. Now that that's blown up in his face, he's trying to redirect focus to Alameda's bad trades rather than all the shady stuff he did.

But Alameda failed to sufficiently hedge against the risk of an extreme market crash: the hundred billion of assets had only a few billion dollars of hedges. It had a net leverage–[net position - hedges]/NAV–of roughly 1.06x; it was long the market.

As a result, Alameda was in theory exposed to an extreme market crash–but it would take something like a 94% crash to bankrupt it.

2022 Market Crashes

Alameda, then, entered 2022 with roughly:

- $100b NAV

- $8b net borrow

- 1.06x leverage

- Tens of billions of dollars of liquidity

Then, over the course of the year, markets crash–again and again and again. And Alameda repeatedly fails to sufficiently hedge its position until mid summer.

- BTC crashed 30%

- BTC crashed another 30%

- BTC crashed another 30%

- rising interest rates curtailed global financial liquidity

- Luna went to $0

- 3AC blew out

- Alameda's co-CEO quit

- Voyager blew out

- BlockFi almost blew out

- Celsius blew out

- Genesis started shutting down

- Alameda's borrow/lending liquidity went from ~$20b in late 2021 to ~$2b by late 2022

Wow, that sure sounds like a lot of opportunities in which FTX could have looked into what was happening with Alameda's positions and reduced their risk instead of digging a deeper hole!

Per the SEC: "At the same time that Bankman-Fried was positioning himself as a hero in the industry, however, the plummeting value of crypto assets was impacting Alameda, and as a result impacting FTX. As discussed above, as a result of the same market conditions impacting BlockFi's liquidity, many of Alameda's lenders demanded repayment of loans they had made to Alameda. Bankman-Fried directed Alameda to draw down billions of dollars from its 'line of credit' from FTX to repay some of its loans—money that came from FTX's spot market funded by FTX customers. Thus, in the summer of 2022, Bankman-Fried knew, or was reckless in not knowing, that FTX was in a precarious financial condition. However, he continued to spend hundreds of millions of dollars to purchase and support other crypto companies, and allowed Alameda to use FTX customer funds to repay its debts. In addition, Bankman-Fried and other FTX executives continued to withdraw customer funds in the form of the poorly documented and undisclosed 'loans' described above." 44

SBF goes on for a while about Alameda's assets, does some whataboutism about the general downturn in crypto and stock markets, and suggests that a year-long period was apparently not enough time to discover that Alameda had become more highly leveraged then he realized.

It's ultimately unimportant given that it's not Alameda's specific trades that were the big problem, and I've already discussed the issues with how SBF estimates Alameda's assets' value, so I've omitted it.

Margin Trading

Crucially, FTX is the only crypto platform in this list that was not a crypto lender.

Customers of Voyager, Celsius, BlockFi, Genesis, and Gemini understood that they were handing over their funds to the company to lend to other entities, and they accepted that there is some risk that comes with that. There are absolutely open questions surrounding all of these platforms, some of which may result in criminal charges, but crucially, it was not news to these customers that their funds were being used for lending.

On the other hand, FTX's terms of service promised customers that "Title to your Digital Assets shall at all times remain with you and shall not transfer to FTX Trading... None of the Digital Assets in your Account are the property of, or shall or may be loaned to, FTX Trading; FTX Trading does not represent or treat Digital Assets in User's Accounts as belonging to FTX Trading." 46

It's true that when you offer highly leveraged trading (as FTX did), there is a risk that sudden and major market movements can get you into a sticky situation.

However, if you're running a highly leveraged trading business, and you wax poetic at every opportunity about your top-notch risk management engine and careful controls, and then the business collapses because you don't have those things, that is still fraud. The SEC seems to feel the same way. 47

Crucially, though, it was not a sudden drop in the broad crypto markets that caused FTX to collapse—in fact, Bitcoin had been trading pretty flat for months before FTX collapsed (causing Bitcoin to tank on November 7–9, not the other way around). It was the collapse of tokens that were so tightly tied to FTX that they effectively represented sentiment in FTX's stability, and which SBF had used to prop up the whole operation, that brought down FTX. And the token collapse itself was kicked off by the leak of an Alameda balance sheet on November 2. 48 Basically, FTX collapsed because people learned what was going on at FTX.

The November Crash

Then came CZ's fateful tweet, following an extremely effective months-long PR campaign against FTX–and the crash.

Perhaps someday SBF will take a moment to wonder how it came to be that FTX was so fragile that a single tweet from CZ could bring it crashing down.

As for CZ's "extremely effective months-long PR campaign", his various jabs at FTX did not seem terribly different from the standard crypto infighting, or the types of tweets SBF occasionally lobbed at CZ. 50

Up until that final crash in November, QQQ had moved roughly half as much as Alameda's portfolio, and BTC/ETH had moved roughly 80% as much–meaning that Alameda's hedges (QQQ/BTC/ETH), to the extent they existed, had worked. Unfortunately the hedges hadn't been sufficiently large until after the 3AC crash–but as of October 2022, they finally were.

But the November crash was a targeted attack on assets held by Alameda, not a broad market move. Over the few days in November, Alameda's assets fell roughly 50%; BTC fell about 15%--only 30% as much as Alameda's assets–and QQQ didn't move at all. As a result, the larger hedge that Alameda had finally put on that summer didn't end up helping. It would have for every previous crash that year–but not for this one.

Were they? Matt Levine:

[T]o hedge the market risk that that stuff would lose value, it shorted "some combination of BTC, ETH, and QQQ," that is, an exchange-traded fund of Nasdaq stocks. If the market — Solana and FTT and Bitcoin and the Nasdaq — went up, Alameda would make money on its positions but lose money on its hedges. If the market — all that stuff — went down, Alameda would lose money on its positions but be cushioned by its hedges.

If Solana and FTT went down a ton, but Bitcoin and the Nasdaq did not, Alameda would get vaporized and the hedges wouldn't help. The hedges were only as good as their correlation to Alameda's assets. ...

FTX loaned billions of dollars to Alameda against assets that could, and did, evaporate because CZ tweeted mean things about them. Oh but Alameda was hedged! It hedged by shorting Apple. It could only go bankrupt if its assets lost their value — because of a mean tweet — but Apple did not. What were the chances of that? Incredibly high! Come on." 51

Over the course of November 7th and 8th, things went from stressful but mostly under control to clearly insolvent.

By November 10th, 2022, Alameda's balance sheet had only ~$8b of (only semi-liquid) assets left, versus roughly the same ~$8b of liquid liabilities:

And a run on the bank required immediate liquidity—liquidity that Alameda no longer had.

A major reason that Credit Suisse didn't go under was that, being a fully regulated bank, they were required to hold high-quality, liquid assets that would support larger-than-usual withdrawals. 52

No such regulation applied to FTX, and they clearly were not doing so.

Putting that aside, though, FTX's customers who were not trading with leverage expected that FTX was simply holding on to their crypto for them—not sending it off to Alameda to trade with. A "bank run" (exchange run?) should not have been possible, because FTX should have just been holding on to customer crypto.

And so, as Alameda became illiquid, FTX International did as well, because Alameda had a margin position open on FTX; and the run on the bank turned that illiquidity into insolvency.

Meaning that FTX joined Voyager, Celsius, BlockFi, Genesis, Gemini, and others that experienced collateral damage from the liquidity crunch of their borrowers.

All of which is to say: no funds were stolen. Alameda lost money due to a market crash it was not adequately hedged for–as Three Arrows and others have this year. And FTX was impacted, as Voyager and others were earlier.

If you promise to do nothing besides hold on to your customers' funds, and then you break that promise, that is stealing.

If you take out billions in "loans" from your company that you never pay back, that is stealing.

Coda

Even then, I think it's likely that FTX could have made all customers whole if a concerted effort had been made to raise liquidity.

There were billions of dollars of funding offers when Mr. Ray took over, and more than $4b that came in after.

This was not a liquidity problem, this was a solvency problem. If FTX had plenty of assets that were just not sufficiently liquid to meet withdrawals, then they feasibly could have raised liquidity (or paused withdrawals, as some exchanges are wont to do), and things would have been a-ok.

But to raise funds, FTX would have to either a) show potential investors a balance sheet with a massive, multi-billion dollar hole in it, and say "hey can we have your money to throw into this hole too?" or b) lie to them.

If FTX had been given a few weeks to raise the necessary liquidity, I believe it would have been able to make customers substantially whole. I didn't realize at the time that Sullivan & Cromwell—via pressure to instate Mr. Ray and file Chapter 11, including for solvent companies like FTX US–would potentially quash those efforts. I still think that, if FTX International were to reboot today, there would be a real possibility of making customers substantially whole. And even without that, there are significant assets available for customers.

I've been, regrettably, slow to respond to public misperceptions and material misstatements. It took me some time to piece together what I could–I don't have access to much of the relevant data, much of which is for a company (Alameda) I wasn't running at the time.

I had been planning to give my first substantive account of what happened in testimony to the US House Financial Services Committee on December 13th. Unfortunately, the DOJ moved to arrest me the night before, preempting my testimony with an entirely different news cycle. For what it's worth, a draft of the testimony I planned to give leaked out here.

I have a lot more to say–about why Alameda failed to hedge, what happened with FTX US, what led to the Chapter 11 process, S&C, and more. But at least this is a start.

Footnotes

- Complaint ¶ 73, Commodity Futures Trading Commission v. Bankman-Fried et al., No. 1:22-cv-10503 (SDNY Dec. 13, 2022). ECF No. 1.

- Complaint ¶ 4, Securities and Exchange Commission v. Bankman-Fried et al., No. 1:22-cv-10501 (SDNY Dec. 13, 2022). ECF No. 1. ("When prices of crypto assets plummeted in May 2022, Alameda's lenders demanded repayment on billions of dollars of loans. Despite the fact that Alameda had, by this point, already taken billions of dollars of FTX customer assets, it was unable to satisfy its loan obligations. Bankman-Fried directed FTX to divert billions more in customer assets to Alameda to ensure that Alameda maintained its lending relationships, and that money could continue to flow in from lenders and other investors.")

- According to a statement by FTX attorney Andrew Dietderich in the bankruptcy court hearing on January 13, 2023.

- Kadhim Shubber, Celsius Network reveals $1.2bn shortfall in bankruptcy filing , Fin. Times, July 14, 2022.

- Declaration of Stephen Ehrlich in Support of Chapter 11 Petitions and First Day Motions Ex. G, In re Voyager Digital Holdings, Inc. et al., No. 22-10943-MEW (Bankr. SDNY Jul. 6, 2022). ECF No. 15.

- Matthew Goldstein & David Yaffe-Bellany, In Hunt for FTX Assets, Lawyers Locate Billions in Cash and Crypto , N.Y. Times, Jan. 17, 2023.

- Jeff Kauflin, Despite Boasting Of Big Profits, FTX And Alameda Lost $3.7 Billion Before 2022 , Forbes, Nov. 21, 2022; source document Motion of Debtors for Entry of Interim and Final Orders (I) Establishing Notice and Objection Procedures for Transfers of Equity Securities and Claims of Worthless Stock Deductions and (II) Granting Certain Related Relief, In re FTX Trading Ltd. et al., No. 22-11068-JTD (Bankr. D. Del. Nov. 19, 2022). ECF No. 49.

- Complaint, supra note 1, ¶ 60. ("Alameda relied on its significant holdings of FTT and similar illiquid tokens, valued at the market value of the asset without discount, as collateral to support a number of large loans from various digital asset lending platforms.")

- Complaint, supra note 2, ¶ 29. ("[T]he collateral Alameda deposited on FTX consisted largely of illiquid, FTX-affiliated tokens, including FTT.")

- Press release, Securities Commission of The Bahamas, Securities Commission of The Bahamas Seeks Court Direction Regarding Disclosure of Information (Dec. 29, 2022).

- Debtors' Objection to Emergency Motion of the Joint Provisional Liquidators of FTX Digital Markets Ltd. (I) for Relief from Automatic Stay and (II) to Compel Turnover of Electronic Records Under Sections 542, 1519(a)(3), 1521(a)(7) and 1522 of the Bankruptcy Code at 6 n. 9, In re FTX Trading Ltd. et al., No. 22-11068-JTD (Bankr. D. Del. Dec. 30, 2022). ECF No. 335.

- Investigating the Collapse of FTX, Part I: Hearing Before the H. Comm. on Fin. Services , 117th Cong. (2022) (statement of John J. Ray III, Chief Executive Officer, FTX Group at 2:19:17).

- Complaint, supra note 1, ¶ 95.

- Opposition to FTX Debtors' Motion To Enforce The Automatic Stay Or, In The Alternative, Extend The Automatic Stay, In re FTX Trading Ltd. et al., No. 22-11068-JTD (Bankr. D. Del. Jan. 5, 2023). ECF No. 387.

- Emergency Motion for Extension of Time to Respond to Complaint and Turnover Motion and for Continuance of Hearing and Pretrial Conference, Exhibit 5 at 3 ¶ 9, BlockFi Inc. v. Emergent Fidelity Technologies Ltd. (In re BlockFi Inc. et al.), No. 22-01382-MBK (Bankr. D.N.J. Nov. 28, 2022). ECF No. 19-7.

- Lucinda Shen, Exclusive: Sam Bankman-Fried says he's down to $100,000 , Axios, Nov. 29, 2022.

- Ray, supra note 12, at 1:17:17.

- Audio interview by Stephen "Coffeezilla" Findeisen with Sam Bankman-Fried, at 9:44. (December 1, 2022).

- Complaint, supra note 1, ¶ 94–95. ("The FTX executives ultimately identified a shortfall they did not understand and were unable to quantify on FTX US. Bankman-Fried quickly indicated that he would fill the hole at FTX US from liquidation of Alameda assets. On November 8, Bankman-Fried directed Alameda traders to prioritize meeting FTX US capital requirements and to send excess capital to FTX US. On information and belief, Alameda sent in excess of $185 million to FTX US to fill its shortfall.")

- Ray, supra note 12, at 1:15:32.

- Debtors' Objection to Emergency Motion of the Joint Provisional Liquidators of FTX Digital Markets, supra note 11, ¶ 4.

- Id., ¶ 74.

- Order Authorizing the Retention and Employment of Sullivan & Cromwell LLP as Counsel to the Debtors and Debtors-in-Possession Nunc Pro Tunc to the Petition Date, In re FTX Trading Ltd. et al., No. 22-11068-JTD (Bankr. D. Del. Jan. 20, 2023). ECF No. 553.

- Sam Bankman-Fried, written draft of testimony for Investigating the Collapse of FTX, Part I: Hearing Before the H. Comm. on Fin. Services , 117th Cong. (December 13, 2022) (not delivered, published by Forbes).

- Enron case legal tab: $700 million , L.A. Times, Nov. 22, 2007.

- Complaint ¶ 74, Securities and Exchange Commission v. Ellison and Wang, No. 1:22-cv-10794 (SDNY Dec. 21, 2022). ECF No. 1. ("Ellison, at Bankman-Fried's direction, caused Alameda to manipulate the price of FTT by purchasing large quantities of FTT on the open market to prop up its price.")

- FTX balance sheet, revealed , Fin. Times, Nov. 12, 2022.

- Binance (@binance), Twitter (Nov. 9, 2022, 4:00PM). ("As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com.")

- Bennett Tomlin, SBF is being deceitful again , Protos, Jan. 13, 2023.

- Debtors' Motion to Enforce the Automatic Stay or, in the Alternative, Extend the Automatic Stay ¶ 4, In re FTX Trading Ltd., No. 22-11068-JTD (Bankr. D. Del. Dec. 22, 2022). ECF No. 291. ("With news of FTX's imminent collapse making headlines worldwide, just two days before the Debtors (including FTX Trading and Alameda) filed for bankruptcy, BlockFi scrambled to protect itself from impending losses on antecedent loans by threatening to seek remedies against Alameda if Alameda did not pledge additional collateral for those loans. In response to those threats, and despite the perilous financial position of Alameda and the other Debtors, Alameda's then-CEO Caroline Ellison, with knowledge and encouragement from Mr. Bankman-Fried, purportedly agreed to pledge over $1 billion worth of additional Alameda assets to secure Alameda's outstanding loan obligations to BlockFi. The Robinhood Shares were included in these pledged assets by Alameda's then-CEO, despite the fact that the Robinhood Shares were nominally held by Emergent, because Alameda had then, and continues to have, a property interest in the Robinhood Shares.")

- Motion to Dismiss Case Filed by Joint Provisional Liquidators of FTX Digital Markets Ltd., ¶ 14, In re FTX Trading Ltd., No. 22-11068-JTD (Bankr. D. Del. Dec. 12, 2022). ECF No. 213. ("The total amount recorded as owed by FTX Property Holdings to FTX Digital was, as of October 5, 2022, at least $256.3 million.")

- Sam Bankman-Fried (@SBF_FTX), Twitter (Aug. 9, 2022, 5:15PM). ("b) $4.4b of employee comp").

- Declan Harty, A tale of two crypto strategies: While Coinbase added thousands of jobs, Sam Bankman-Fried's FTX stayed lean with just 300 employees—and now plans to capitalize on the carnage , Fortune, June 18, 2022.

- Muyao Shen & Jeremy Hill, Three Arrows Capital Liquidators Demand Documents Via Twitter , Bloomberg, Jan. 5, 2023. ("[T]he pair's whereabouts are unknown and they are not fully cooperating with 3AC's unwinding, the advisers have said.")

- Kelsey Piper, Sam Bankman-Fried tries to explain himself , Vox, Nov. 16, 2022.

- Complaint, supra note 1, ¶ 29.

- Complaint, supra note 2, ¶ 18.

- Is Alameda Research Insolvent? , Dirty Bubble Media, Nov. 4, 2022.

- Chris Prentice, U.S. securities regulator probes FTX investors' due diligence -sources , Reuters, Jan. 6, 2022.

- Complaint, ¶ 2, 61, People of the State of New York, by Letitia James, Attorney General of the State of New York v. Alex Mashinsky, Index No. 450040/2023, NYSCEF No. 2 (NY Sup. Ct. NY Cnty. Jan. 5, 2023).

- CFTC Complaint, supra note 1, ¶ 104.

- Francine McKenna, 'A Complete Failure of Corporate Controls': What Investors and Accountants Missed in FTX's Audits , CoinDesk, Nov. 18, 2022.

- Emily Mason, FTX.US Accounting Firm Armanino Ends Crypto Audit Practice , Forbes, Dec. 15, 2022.

- Complaint, supra note 2, ¶ 71–72.

- Emily Flitter, David Yaffe-Bellany & Matthew Goldstein, FTX Founder Sam Bankman-Fried Is Said to Face Market Manipulation Inquiry , N.Y. Times, Dec. 7, 2022.

- FTX Terms of Service , FTX (May 13, 2022).

- Complaint, supra note 2, ¶ 3. ("[Bankman-Fried] repeatedly cast FTX as an innovative and conservative trailblazer in the crypto markets. He told investors and prospective investors that FTX had top-notch, sophisticated automated risk measures in place to protect customer assets, that those assets were safe and secure, and that Alameda was just another platform customer with no special privileges. These statements were false and misleading.")

- Ian Allison, Divisions in Sam Bankman-Fried's Crypto Empire Blur on His Trading Titan Alameda's Balance Sheet , CoinDesk, Nov. 2, 2022.

- Jonathan Stempel, Corzine in $5 million settlement with US CFTC over MF Global collapse , Reuters, January 5, 2017.

- Sam Bankman-Fried (@SBF_FTX), Twitter (Oct. 30, 3:49am) (deleted, archived at Rebellion Research). ("@rsalame7926 @cz_binance excited to see him repping the industry in DC going forward! uh, he is allowed to go to DC, right?")

- Matt Levine, JPMorgan Says Frank Was Fraud , Bloomberg, Jan. 12, 2023.

- Marc Rubinstein, Bank Runs Just Aren't What They Used to Be , Washington Post, Dec. 8, 2022.

Copyright to the original Substack post belongs to Sam Bankman-Fried, and the article can be read in its original form in full at sambf.substack.com. It is republished here for the purposes of critical commentary.

Molly White has a cryptocurrency disclosure.

Built with annotate. View source.