Activity tagged "FTX"

Interesting: in the government’s sentencing submission for FTX’s Gary Wang, they note he has “created a tool for the detection of potential fraud in the stock market” and is “in the process of developing a similar tool for cryptocurrency markets” for government use.

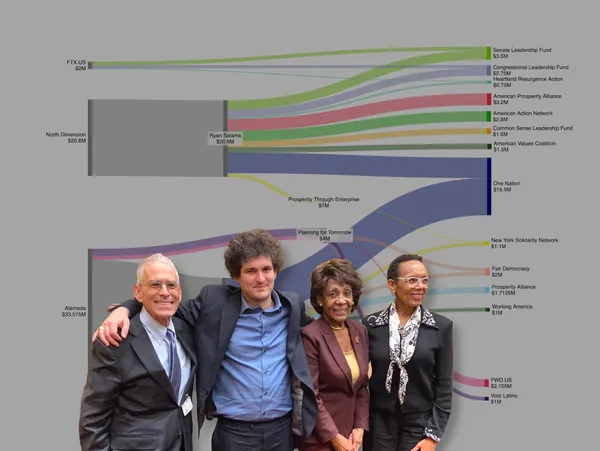

FTX’s Nishad Singh was sentenced to no jail time, and three years of supervised release. He had pleaded guilty to fraud and money laundering charges, as well as a campaign finance charge, and cooperated with the prosecution.

That just leaves defendant Gary Wang left to be sentenced. I imagine he’s feeling some relief after hearing of Singh’s non-custodial sentence.

This also really underscores the sentencing benefit from cooperation. Ryan Salame, who pleaded guilty but did not cooperate, received 7 1/2 years for a campaign finance charge and a money transmitting charge.

Guilty or coerced? Ryan Salame’s last interviews before prison

Caroline Ellison: A woman with agency or a helpless pawn?

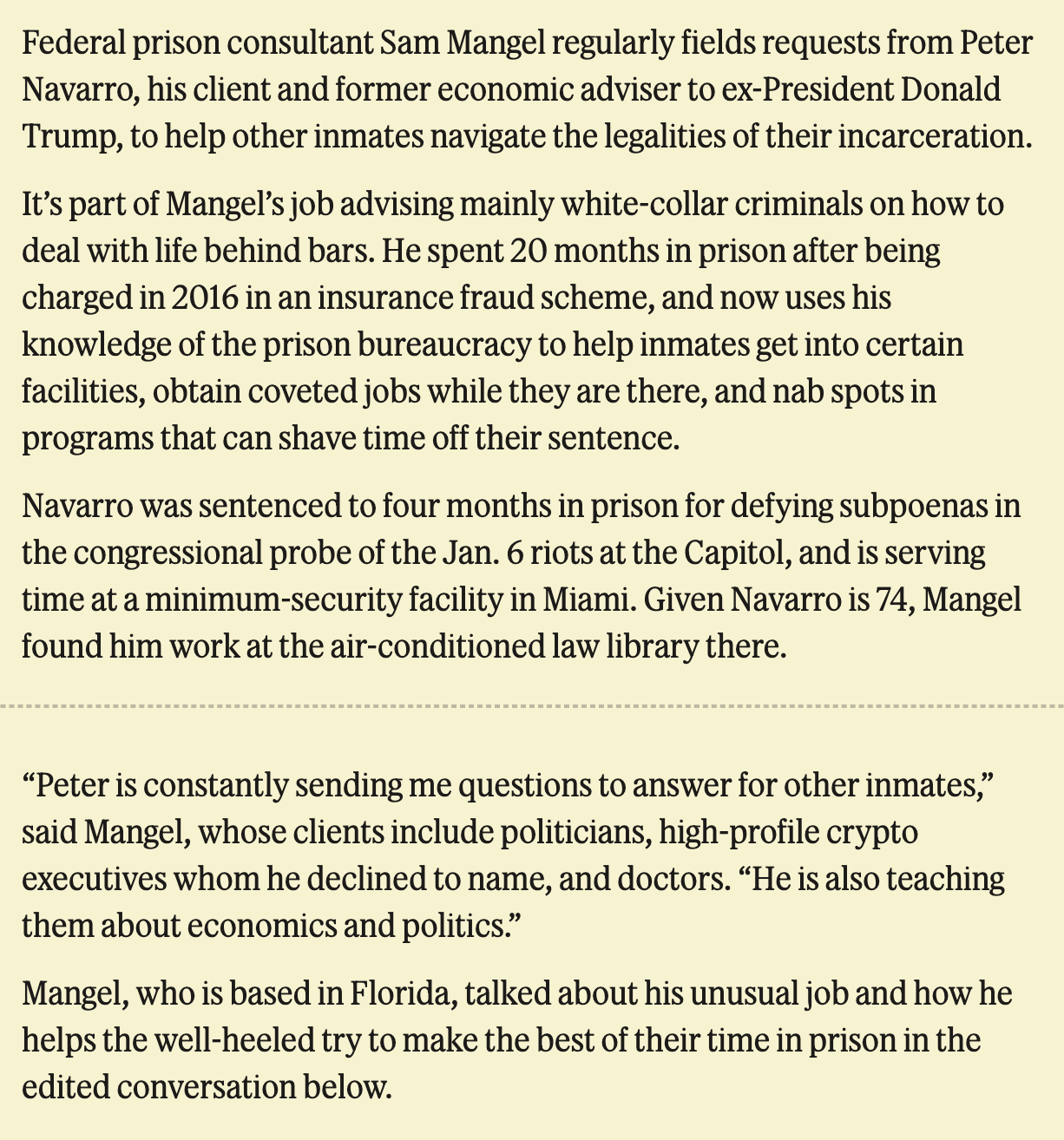

Issue 67 – Bug out bitcoin

Issue 66 – Pretensions to relevance

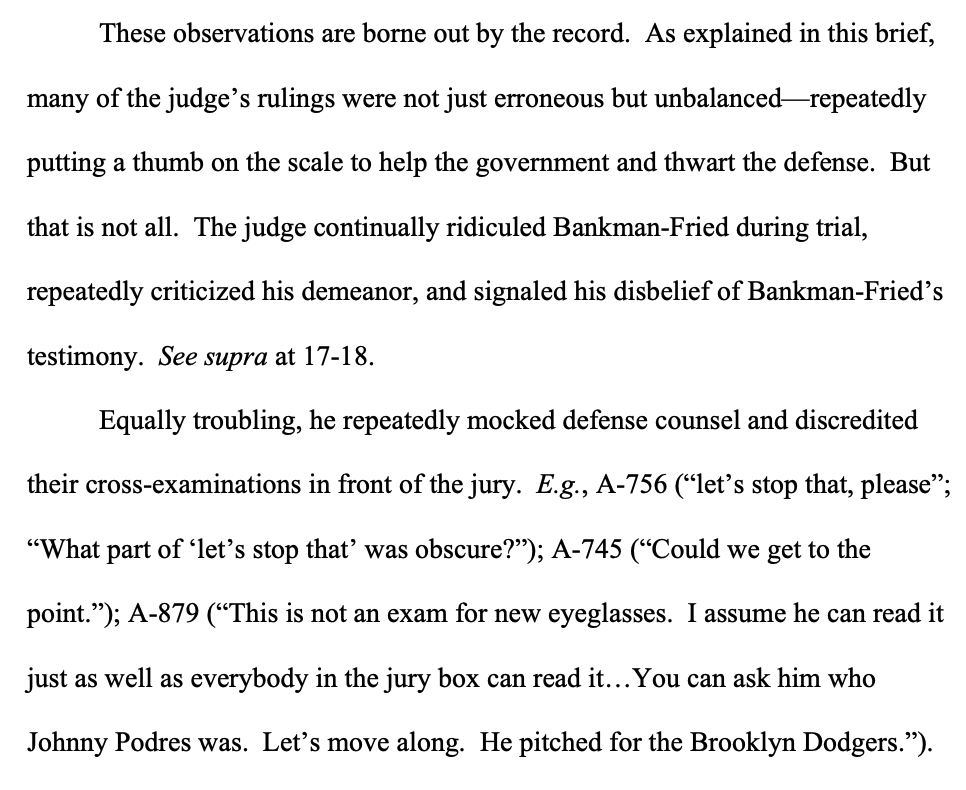

FTX founder Sam Bankman-Fried has just appealed his conviction. He argues, among other things, that the judge didn't like him.

https://www.courtlistener.com/docket/69143697/28/united-states-of-america-v-bankman-fried/

![The computer coding concepts that Wang implemented at FTX have implications for fraud detection. Since he began cooperating with the Government, Wang has created a tool for the detection of potential fraud in the stock market.1 Specifically, [redacted paragraph] 1. The Government respectfully requests that the portion of its sentencing brief providing details about the fraud detection tools being developed by Wang be maintained under seal. The public disclosure of those details could potentially undermine the effectiveness of the tool. The proposed redaction and sealing will still permit the public discussion of the general nature of Wang’s proactive cooperation.](https://storage.mollywhite.net/micro/8729e1a17aee0f377f62_Screenshot-2024-11-13-at-3.26.19---PM.png)

![The tool has significant potential value to the Government. [redacted paragraph] To provide further assistance, Wang is in the process of developing a similar tool for cryptocurrency markets, which – if he is sentenced to a time served sentence – the Government hopes it will be able to take advantage of early next year. Wang’s willingness to use his skills proactively, to help detect other criminal activity in financial markets, distinguishes his cooperation from the vast majority of cooperating witnesses to appear before this Court.](https://storage.mollywhite.net/micro/7316e71ce58ad56d0e35_Screenshot-2024-11-13-at-3.26.32---PM.png)