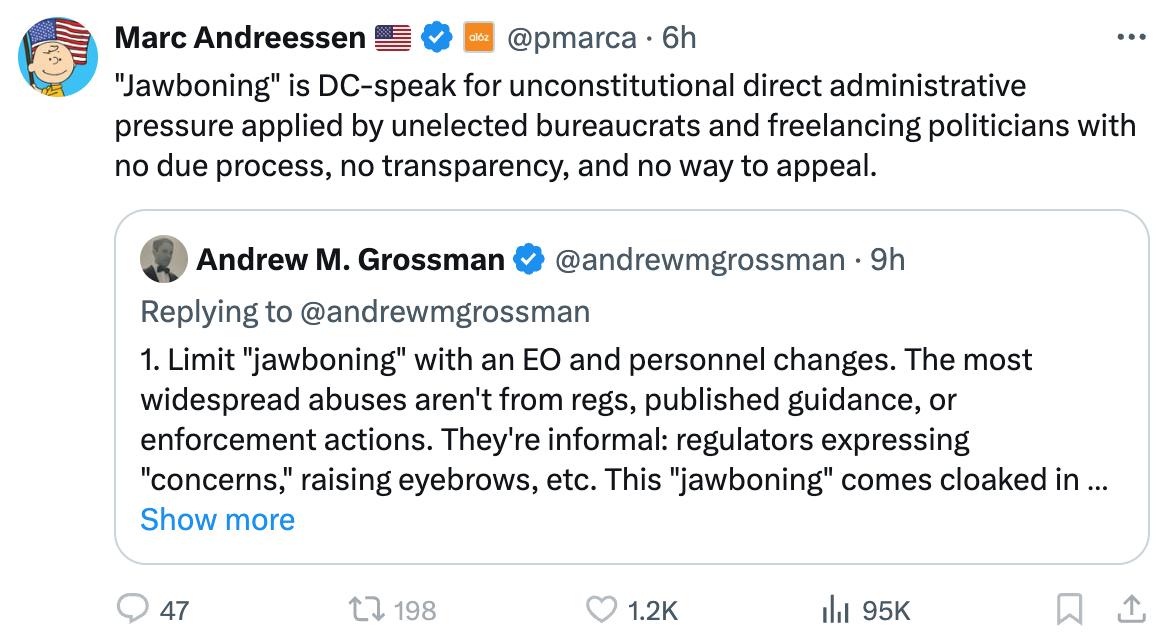

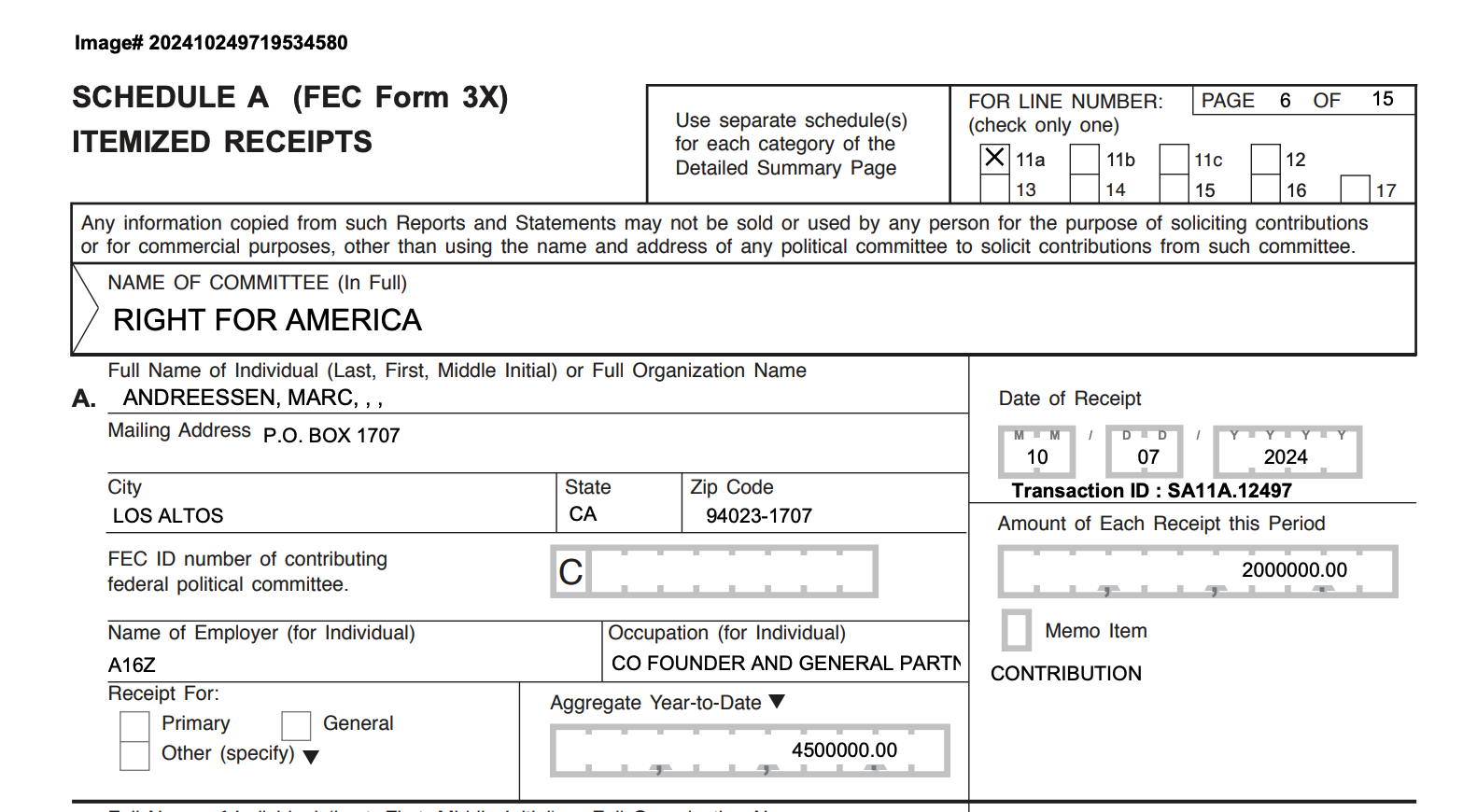

From lending to payments to stock trading to crypto, prominent fintech businesses have found a competitive edge not in technology itself, but in using narratives about technology as a smokescreen for the profitable arbitrage of financial regulations. This modus operandi is encouraged by Silicon Valley’s venture capitalists, who decide which businesses to fund and often provide advice, gin up hype, and lobby for the businesses they’ve chosen. Our society continues to shower VCs with public subsidies, but as I argue in this brief post, if regulatory arbitrage is what we’re getting from Silicon Valley’s VCs in exchange, it’s well past time to reconsider this relationship.

Activity tagged "venture capital"

Issue 71 – (Crypto) banks are not your friends

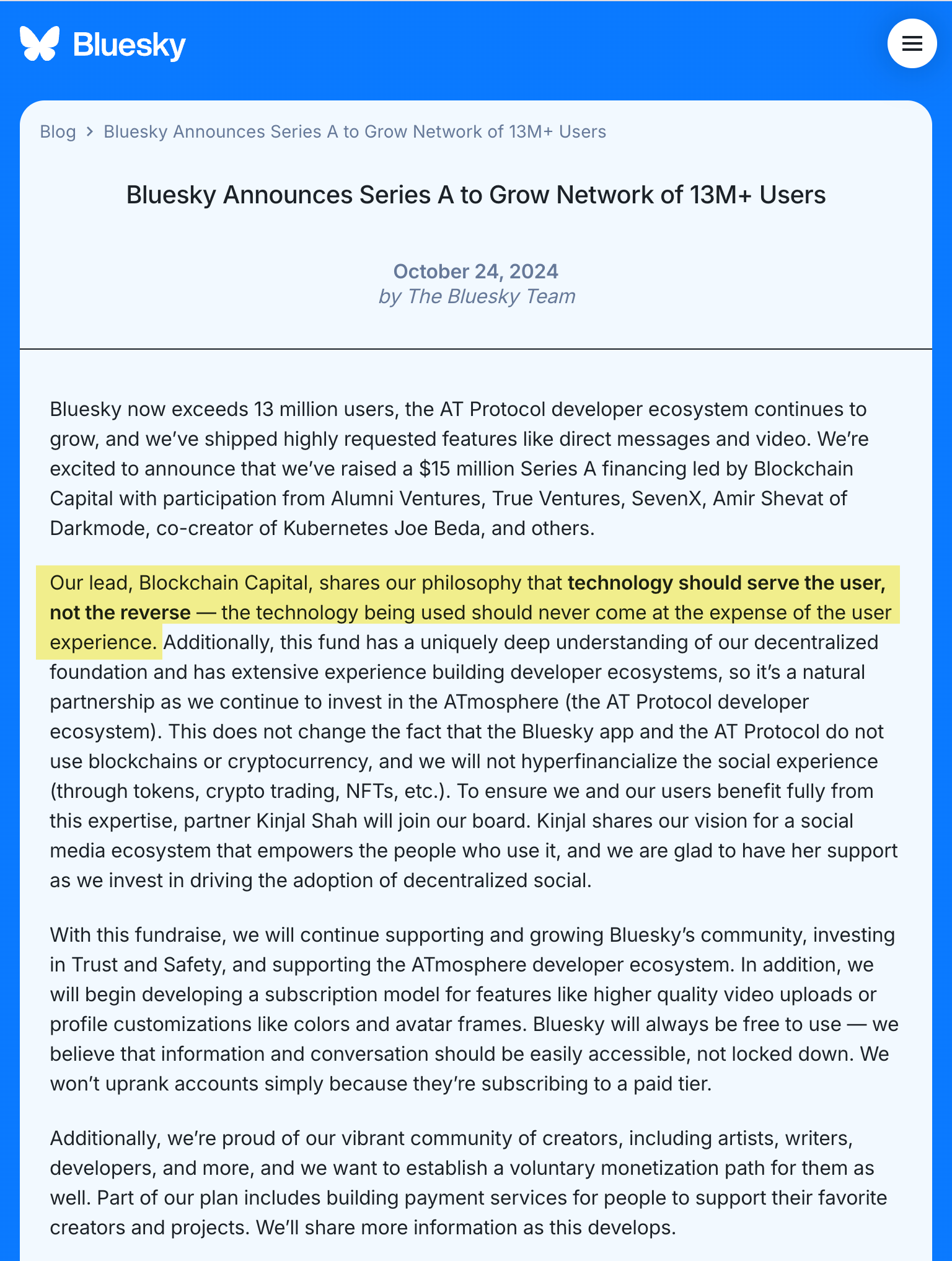

Great piece on BlueSky and enshittification by Cory Doctorow . “I will never again devote my energies to building up an audience on a platform whose management can sever my relationship to that audience at will.” I also really appreciate his point that it’s not the blockchain venture capital that leads to enshittification, it’s the venture capital.

Cory is a fellow POSSE-er (and major inspiration to me when I adopted the practice), and has opted not to use Bluesky. Personally, I’ve gone the route of using the platforms that interest me, even the enshittification-prone ones like Bluesky and Threads, but hedging my bets by plugging them into my POSSE system where they can just as easily be unplugged if need be.

“our lead shares our philosophy that technology should serve the user, not the reverse

this is why they focus on blockchains, a technology basically always used at the expense of its users”

i do think the degree to which bluesky is stressing that they do not use blockchains really underscores how toxic even a faint whiff of blockchain has become to any normal platform

![Tweet thread by David Sacks (@DavidSacks)<br>where do i go to get my own memecoin?<br><br>woah - $487k MC<br>[screenshot of cryptocurrency token statistics]<br><br>Disclaimers: $sacks was created by the community, not me. I have no involvement or financial interest in this. Memecoins have no inherent value. Trade at your own risk. This is for fun not profit.](https://storage.mollywhite.net/micro/%2525%25EF%25BF%25BD%25EF%25BF%25BD%25EF%25BF%25BD%252C%2520%25CC%25AD%2519%25EF%25BF%25BD_Screenshot_20240317-150315.png)

![Tweet thread by David Sacks (@DavidSacks)<br>Does moose deserve his own memecoin?<br>[photo of a brown, white, and tan English bulldog laying on a blue bed]<br><br>Moosecoin?](https://storage.mollywhite.net/micro/D%25EF%25BF%25BDY%25EF%25BF%25BD%25EF%25BF%25BD%25EF%25BF%25BD%251A%25EF%25BF%25BD%25EF%25BF%25BD%25EF%25BF%25BD_Screenshot_20240317-150134.png)