Alex Mashinsky has been sentenced to twelve years in prison for his Celsius fraud, which culminated in the mid-2022 collapse of his US-based cryptocurrency lending firm with customers suffering losses of more than half a billion dollars.

Thoughts tagged "crypto"

Short thoughts, notes, links, and musings by Molly White. RSS

GENIUS Act stablecoin bill stalls in the Senate

The GENIUS Act stablecoin bill has stalled in the Senate with key Democrats — including some of its early co-sponsors — voting against it. Democratic opposition increased after Trump’s World Liberty Financial cryptocurrency platform released its own stablecoin, allowing the president to profit from transactions including a $2 billion deal between the Emirati state-owned investment firm and the Binance crypto platform.

Senators who voted against the bill include Ruben Gallego (AZ), Mark Warner (VA), Lisa Blunt Rochester (DE), Andy Kim (NJ), Kirsten Gillibrand (NY), and Angela Alsobrooks (MD). Gallego was one of the top recipients of crypto industry campaign funds in 2024, receiving $10 million in crypto super PAC backing.

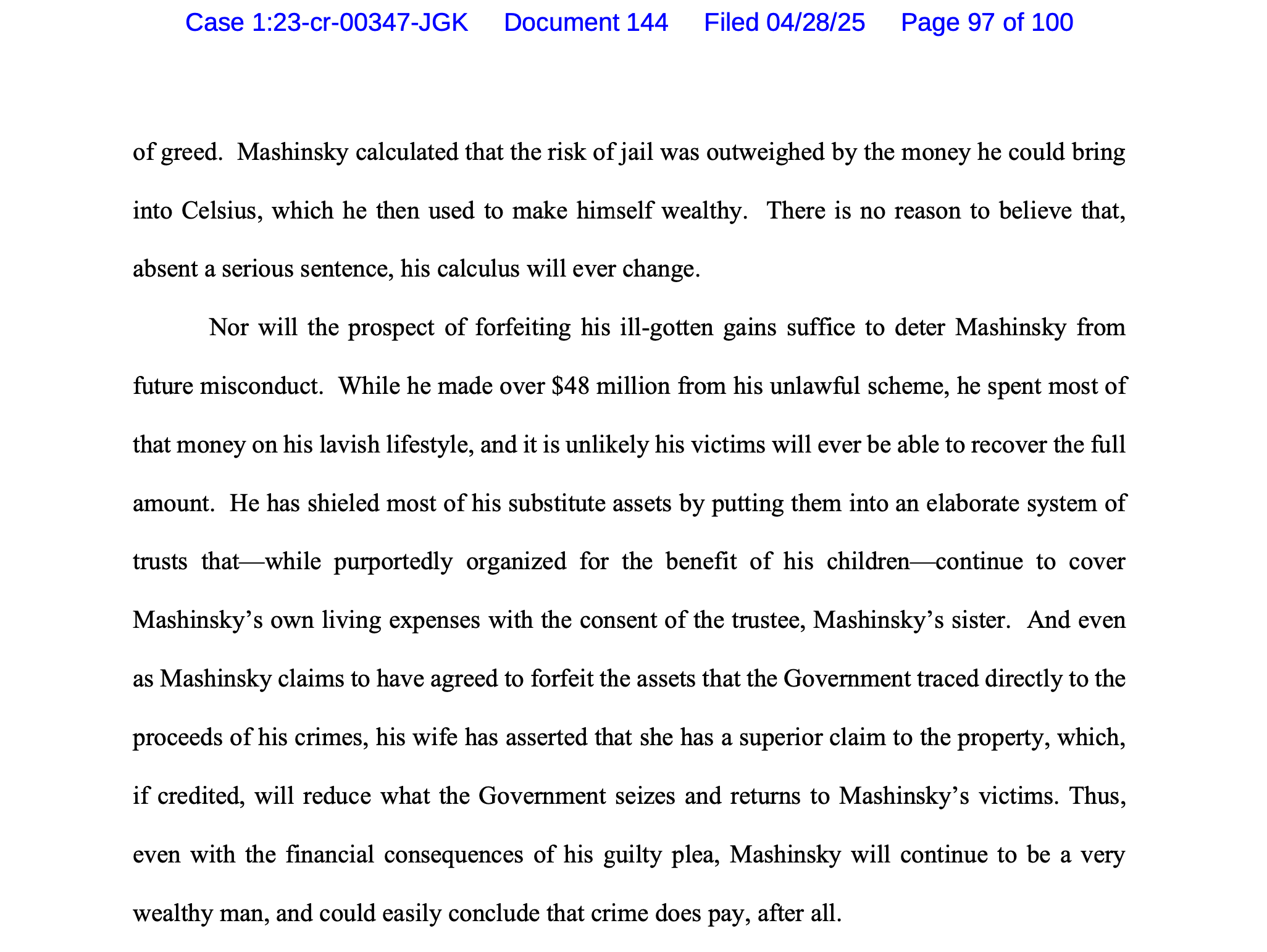

Prosecutors have requested Alex Mashinsky, CEO of the collapsed Celsius cryptocurrency company, be sentenced to at least twenty years in prison for his "sustained, calculated campaign of deceit carried out over years, targeting ordinary people."

Prosecutors say that such a severe sentence is necessary not only for deterrence, but because despite his guilty plea, Mashinsky has not fully accepted responsibility for his actions.

Sentencing guidelines recommend a 30 year sentence, which is only because of the statutory cap resulting from his guilty plea agreement; otherwise the recommendation would be life. Mashinsky has argued he should be sentenced to no more than a year in prison. Sentencing will happen on May 8.

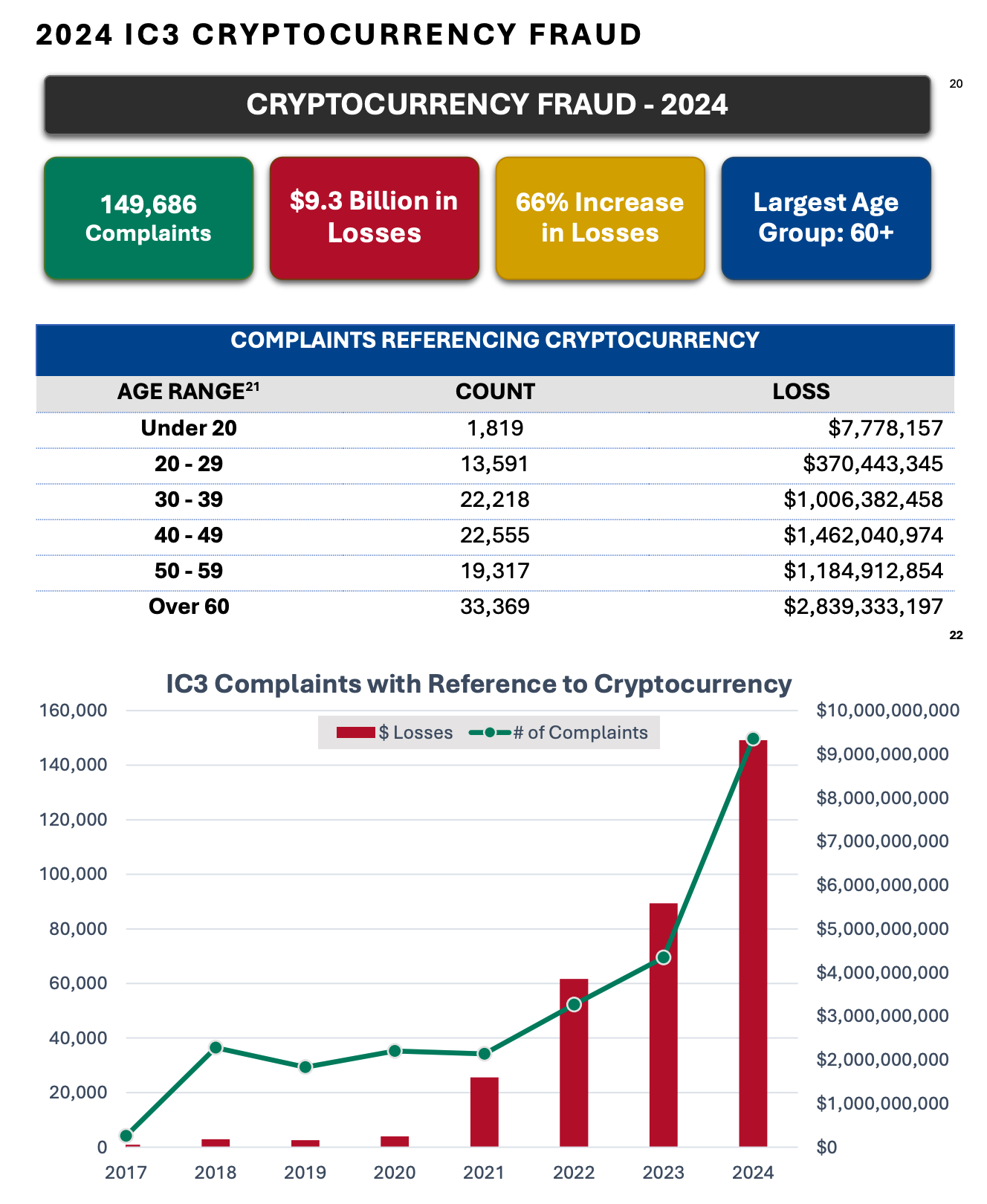

FBI: Americans aged 60 and older reported losing almost $3 billion to crypto fraud last year. In total, Americans reported being scammed out of around $9.3 billion via crypto, out of a total $16.6 billion in total reported losses that year.

The 60+ category reported $4.885 billion in total Internet crime-related losses to the FBI, and $2.839 billion of them involved crypto (58%).

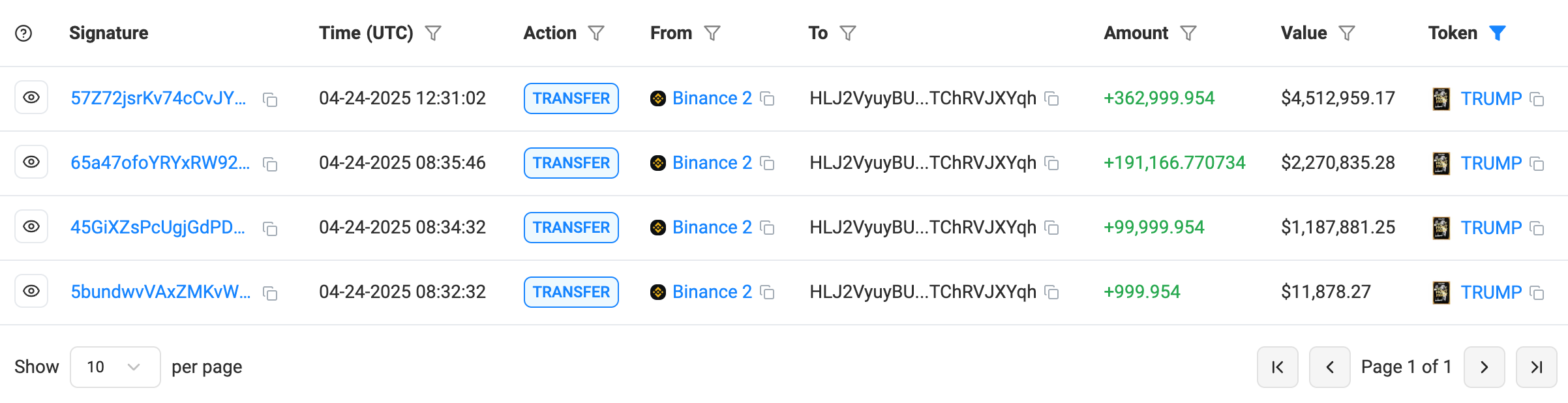

Yuga Labs is looking to obtain a court order to seize possession of four crypto wallets from Jeremy Cahen, co-defendant in the Yuga v. Ryder Ripps case where Yuga won a nearly $9 million judgment.

Yuga has previously tried to collect the judgment via levies on Cahen’s various banks, as well as Robinhood, Gemini, Crypto.com, Coinbase, and Binance.

They claim that these four wallets contain almost $400,000 in crypto assets Cahen moved out of his Gemini account while Yuga was attempting to collect.

“This transfer occurred before Gemini froze his accounts, showing a deliberate and calculated move to shield his assets from the Final Judgment. Cahen’s actions here are not those of an individual passively awaiting the collection process but rather an intentional effort to evade payment at all costs.”

They also claim that “Cahen has made a mockery of this Court’s Final Judgement by refusing to pay any portion of the judgment or comply with any post-judgment discovery.” (Cahen has argued that he need not comply while an appeal is pending.)

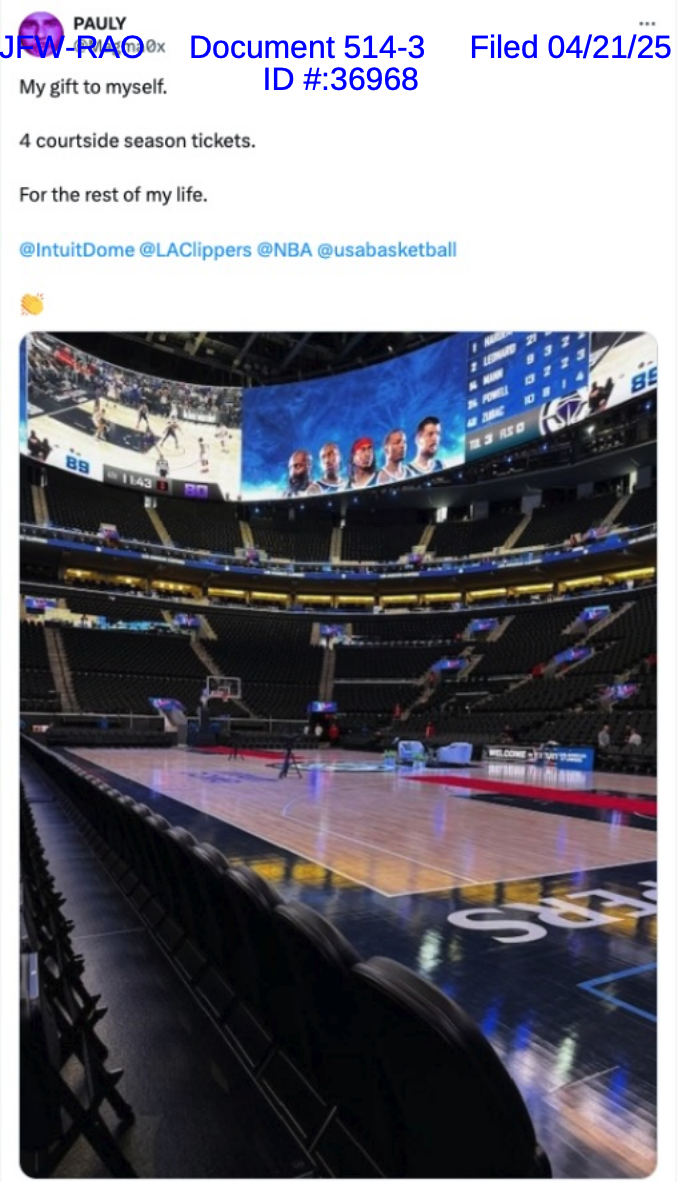

Yuga argues, citing his various Twitter accounts, that Cahen “regularly flouts [sic] his supposed wealth by sitting courtside at Los Angeles Clippers games”.

It’s not clear when he made this tweet, though. In February he was listed among the 10 Most Wanted in Puerto Rico on assault charges, and so likely wasn’t attending many Clippers games. (He has since been removed from this list, though it’s unclear if the charges were resolved.)

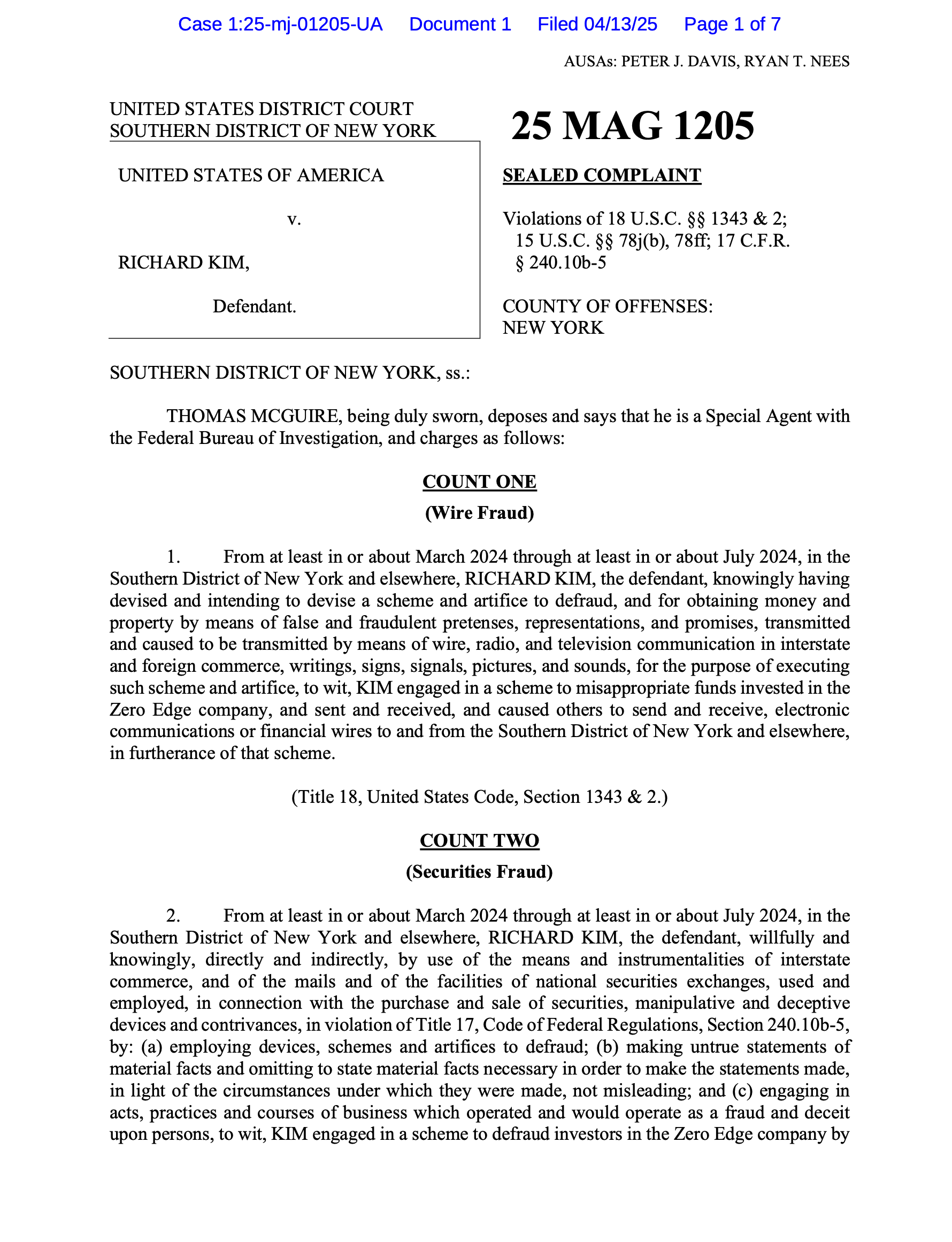

Zero Edge crypto casino founder Richard Kim has been charged with wire fraud and securities fraud after soliciting investments for his crypto casino and then gambling them away. He was arrested and released on bond.

Crypto lobby: “Sure, Trump nixed the Crypto Enforcement Team, directed Major Fraud prosecutors to stop prosecuting crypto cases, and is trying to exempt crypto platforms from the BSA, but they wrote right here that they care about stopping crypto crime!”

Trump has directed the Department of Justice to stop pursuing crypto fraud, dismantling the National Cryptocurrency Enforcement Team and ordering the Market Integrity and Major Frauds Unit to cease cryptocurrency enforcement.

(Memo, archive link)