Quote from man sued: "What are you gonna do, sue me?"

Kevin O'Leary has sued crypto personality Ben Armstrong (aka "BitBoy Crypto") for repeatedly claiming O'Leary murdered two people.

(O'Leary and his wife were indeed involved in a boating collision that killed two people in 2019; O'Leary states in the lawsuit that it was his wife driving the boat, and she was acquitted of any charges.)

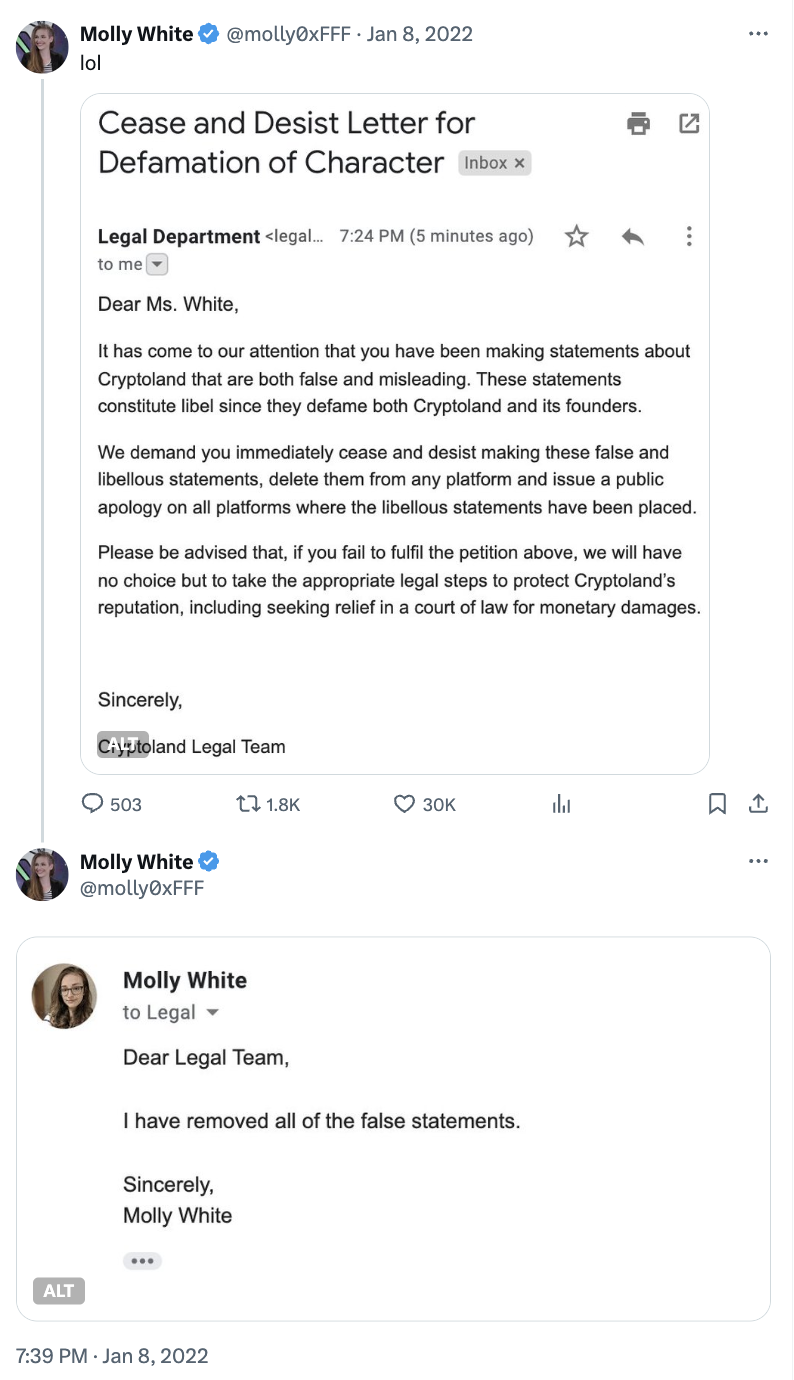

BitBoy also suggested that O'Leary was trying to have him killed, and claimed he'd swatted him. Shortly after, he posted O'Leary's cell phone number and encouraged his followers to "call a real life murderer"

Amusingly, BitBoy once tried to file a defamation lawsuit of his own against a YouTuber who called him a "shady dirtbag". He dropped the suit almost immediately after the YouTuber raised over $200,000 for his defense, and Armstrong admitted he didn't know lawsuits were public.

It's not clear that BitBoy even knows he's been sued yet; he was arrested two days ago after sending threatening emails to the judge in a different defamation case he's facing from his former business partners after he publicly accused them of various crimes.

![27. On March 19, 2025, Armstrong unleashed another tweet accusing O’Leary of committing “actual crimes”: “Doesn’t everybody think it’s weird that I’ve been publicly calling … @kevinolearytv [a] murderer[] and yet not a single word or legal action? It’s almost like they ‘can’t’ because a lawsuit would open up their actual crimes and they know it.”](https://storage.mollywhite.net/micro/cc6240fece1a25cdb952_Screenshot-2025-03-27-at-11.15.02---PM.png)

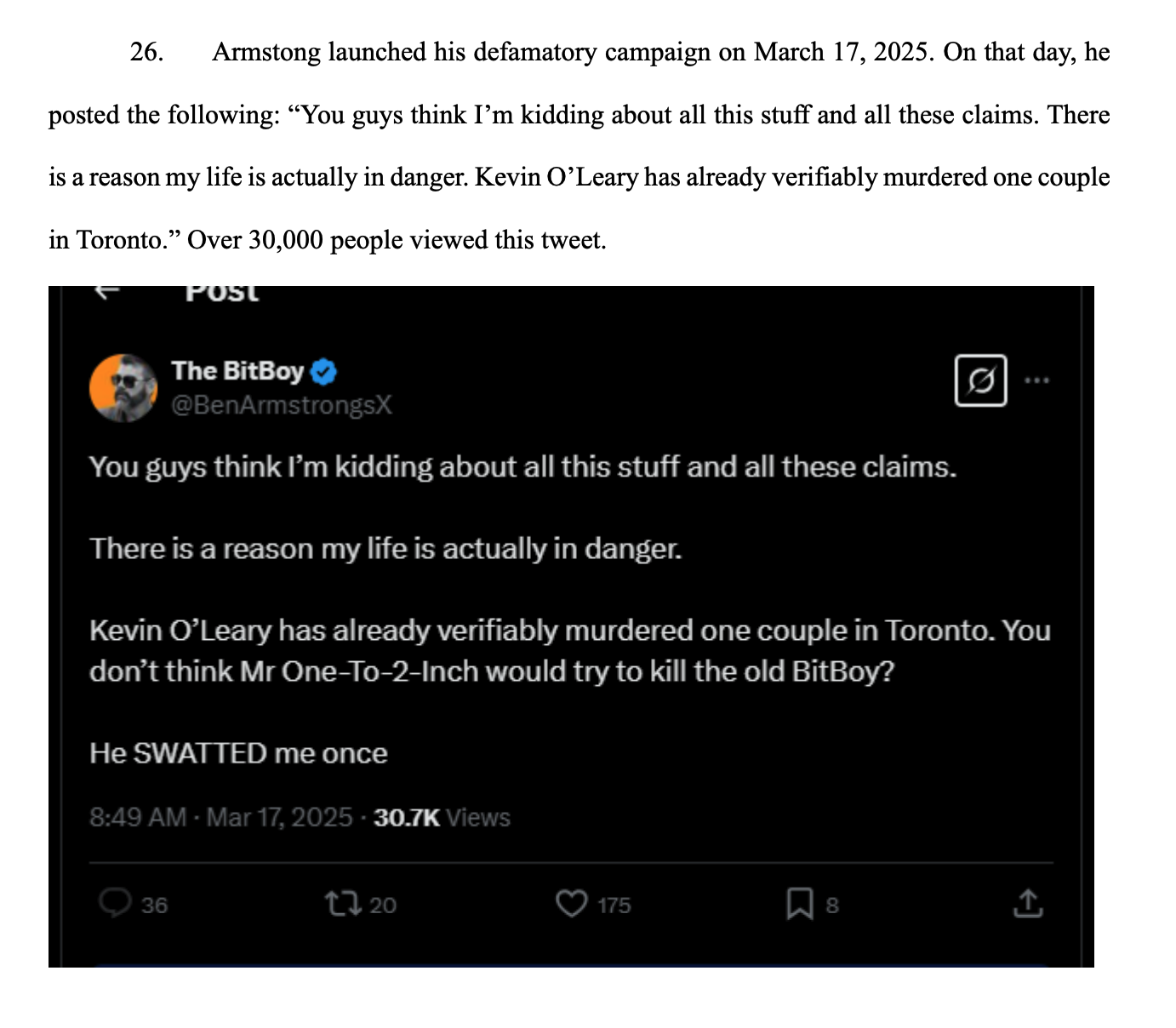

![Screenshot of Molly White’s Citation Needed newsletter: “Recently, there has been a push by the cryptocurrency industry to portray crypto as a major issue that will influence votes in the upcoming election season. This just so happens to coincide with Donald Trump's recent statements suggesting he's warmed to the industry. Although Trump personally has actually been far more vocally anti-crypto than Joe Biden — in 2021 saying bitcoin “just seems like a scam”1 and reportedly ordering Treasury Secretary Steve Mnuchin to “go after bitcoin” in 20182 — that hasn’t stopped many in the cryptocurrency world from embracing him as the supposedly pro-crypto candidate anyway.

Screenshot of Trump tweets: I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity....

....Similarly, Facebook Libra’s “virtual currency” will have little standing or dependability. If Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations, just like other Banks, both National...

...and International. We have only one real currency in the USA, and it is stronger than ever, both dependable and reliable. It is by far the most dominant currency anywhere in the World, and it will always stay that way. It is called the United States Dollar!

It's not entirely clear why Trump has done a U-turn. Perhaps it's simply because supporting crypto has become the Republican thing to do. Perhaps it was because he himself discovered the grift potential this industry unlocks when released his own set of NFTs in 2022 [W3IGG]."](https://storage.mollywhite.net/micro/df4feefa2858d25e523c_www.citationneeded.news_2024-cryptocurrency-election-spending_-iPad-Mini-.png)

![The immutable smart contracts at issue in this appeal are not property because they are not capable of being owned. More than one thousand volunteers participated in a “trusted setup ceremony” to “irrevocably remov[e] the option for anyone to update, remove, or otherwise control those lines of code.” And as a result, no one can “exclude” anyone from using the Tornado Cash pool smart contracts. In fact, because these immutable smart contracts are unchangeable and unremovable, they remain available for anyone to use and “the targeted North Korean wrongdoers are not actually blocked from retrieving their assets,” even under the sanctions regime. Simply put, regardless of OFAC’s designation of Tornado Cash, the immutable](https://storage.mollywhite.net/micro/5c9f39635b98489b176d_Screenshot-2024-11-26-at-7.01.20---PM.png)

![Plaintiff, through individual intelligence, entrepreneurship and human ingenuity, along with the aid of God, is in the professional business of servicing subprime auto loans generated by an affiliated Car Dealership, alongside an internally-partnered, financial services institution ["Bank"].](https://storage.mollywhite.net/micro/242e61648aa0a46d7a94_Screenshot-2024-10-31-at-7.35.49---PM.png)